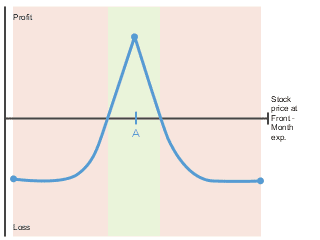

You create the at the money (ATM) put calendar spread setup with the combination of these two options:

- Selling (writing, short) a near-term put at the money (where strike price and stock price are equal or close to equal) with a short expiration typically less than 30 days and,

- purchasing (holding, long) a later-expiring put with the same strike price as step 1 above. This position creates a net debit that you will pay upon trade entry.

When establishing an at the money (ATM) put calendar spread, the legs of the spread are created by zeroing in on a stock that is neutral to slightly bearish and expected to stay near expiring put. The position benefits from time decay as the puts have time value with no intrinsic value (since they are bought and sold at the money).

It is a calendar or time spread because the strike prices of the sold put (sold with the near expiration) and the purchased later-expiring put share the same strike price. The trader looks to profit from decay of the short put while simultaneously covering their risk of the stock moving significantly lower by purchasing the longer-dated put.